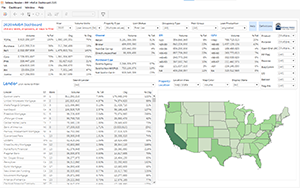

IMF HMDA Dashboard: 2023

Product Details

Thanks to the Home Mortgage Disclosure Act, your competitors have made available a wealth of information about their 2023 mortgage lending. And with the Inside Mortgage Finance HMDA Dashboard, you can easily mine that trove of data for all sorts of competitive intelligence.

With the IMF HMDA Dashboard, you’ll be able to pull out just the information you need, looking at the total market or concentrating on a particular geographic area, a peer group, one or more specific lenders, an underwriting characteristic or any combination of these factors and more. Use the insight to figure out how your product mix or results compare to the market or similarly chartered organizations, where you can expand your efforts, or who might help you grow your business.

The IMF HMDA Dashboard is as easy to use as it is powerful. You’ll be fluent in how to use the Dashboard in just a handful of minutes and poring over your first heat map (and the specific numbers behind it) just a minute or two later.

Best of all, it’s a snap to get those numbers from the IMF HMDA Dashboard to your ultimate use. For example, with one quick menu command you can export the numbers to Excel for further analysis or you can grab the data as an image to include in a presentation so you can show others what you’ve uncovered.

No other resource makes the HMDA data so easy to use—or so valuable:

+ With access to the numbers from each lender required to file HMDA data, your analysis can span the breadth of the market, not just the biggest players.

+ Narrow or broaden your search with just a click and see immediately how the numbers change by lender and geography.

+ Because you can search for lenders by name and view more than one at a time, you can get directly to the information you want and compare, contrast and aggregate information according to your needs.

The IMF HMDA Dashboard gives you access to the 2023 origination data, including dollar volume, change from 2022 and market share, for all lenders required to file HMDA data for 2023—thousands of your competitors and potential partners. You also have access to the 2016 to 2022 dashboards. You can filter the data by any combination of the following:

- Loan purpose (purchase or refinance)

- Loan type (conventional-conforming, FHA, jumbo, etc.)

- Property type

- Lien type

- Occupancy type

- Underwriting characteristics (DTI, LTV)

- Application channel

- Secondary-market purchaser

- Geographic area (one or more states or counties)

- Peer group (similarly chartered or sized lenders)

- Lender

The 2023 HMDA Dashboard also includes flags that allow you to include or exclude originations based on whether the loan is for a line of credit, reverse mortgage, higher-priced mortgage, business or commercial purpose or is interest-only, balloon-payment, or negative amortization.

Let the Home Mortgage Disclosure Act work for you.

Order the IMF HMDA Dashboard now.

Accessing the Inside Mortgage Finance HMDA Dashboard requires the ability to read a Tableau .twbx file. Download the free Tableau reader here.